Key information

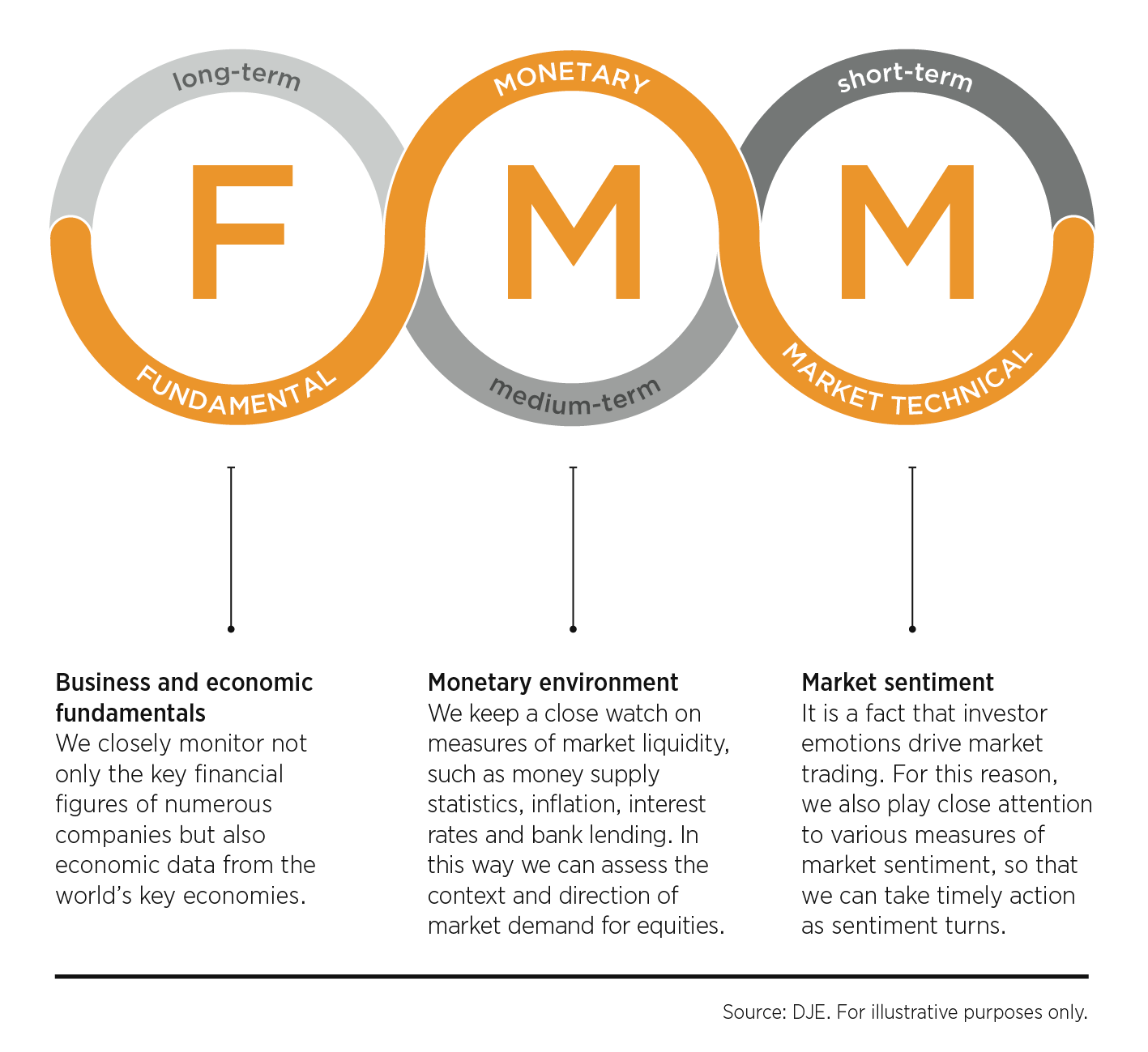

The fund invests globally, primarily in equities and bonds, and completely independent from benchmark requirements. The asset allocation of is based on the FMM methodology with equities being the main focus. The FMM-Fonds was launched in 1987 it was the first fund managed by an independent asset manager in Germany. FMM stands for the following market indicators: fundamental, monetary and market sentiment. The fund invests both in value stocks and in promising growth companies. All the companies are required to meet the strict analytical criteria of the FMM methodology.

Responsible manager since inception

Key information

| ISIN: | DE0008478116 |

| WKN: | 847811 |

| Category: | Fund EUR Aggressive Allocation - Global |

| Minimum Equity: | 60% |

| Partial Exemption of Income ¹: | 30% |

| VG/KVG: | DJE Investment S.A. |

| Fund Manager: | DJE Kapital AG |

| Risk Category: | 4 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | accumulation |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 17/08/1987 |

| Fund currency: | EUR |

| Fund Size (25/07/2024): | 625,49 Mio EUR |

| Ongoing Charges p.a. (31/12/2020): | 1,62% |

| Reference Index: | MSCI World |

Fees

| Initial Charge: | 5,000% |

| Management Fee p.a.: | 1,550% |

| Custodian Fee p.a.: | 0,030% |

| Advisory Fee p.a.: | 0,00% |

Ratings & Awards (25/07/2024)

| Morningstar*: |

|

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | AA |

| ESG-Qualityrating (0-10): | 7,144 |

| Environment Rating (0-10): | 6,128 |

| Social Rating (0-10): | 5,647 |

| Governance-Rating(0-10): | 5,963 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 41,650% |

| Peergroup: |

Mixed Asset EUR Agg - Global

(449 Fonds) |

| Coverage rate ESG rating: | 92,713% |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 245,235 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/06/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent vs. Reference Index

Rolling performance in %

Risk metrics (25/07/2024) |

|

|---|---|

| Standard Deviation (1 years): | 7,26% |

| Tracking Error (1 years): | 9,70% |

| Value at Risk (99% / 20 days): | -4,46% |

| Maximum Drawdown (1 year): | -3,90% |

| Sharpe Ratio (1 years): | 0,41 |

| Correlation (1 years): | 0,34 |

| Beta (1 years): | 0,35 |

| Treynor Ratio (1 years): | 8,44 |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/06/2024

Top Country Allocation in % of Fund Volume (28/06/2024) |

|

|---|---|

| Germany | 24,33% |

| United States | 23,82% |

| Japan | 11,98% |

| France | 3,71% |

| Ireland | 3,58% |

Asset allocation in % of the fund volume (28/06/2024) |

|

|---|---|

| Stocks | 74,87% |

| Cash | 13,19% |

| Bonds | 8,84% |

| Certificates | 2,26% |

| Funds | 0,85% |

Investment strategy

The FMM-Fonds is an investment concept which is managed independently of any benchmark constraints with the aim to achieve an optimal risk/reward profile. The basis is the three-dimensional FMM-methodology, which was developed by Dr Jens Ehrhardt and has a proven track record of approx. 50 years. According to the methodology the following factors are taken into account: (F)undamental factors like micro- and macroeconomic data for corporations and economies, but also (M)onetary and technical (M)arket aspects such as sentiment which are often neglected by other fund managers. Fundamental factors play a more important role in the long-term strategic orientation of the portfolio than, for example, technical market factors. The latter are more significant for the fund’s short-term, tactical positioning. In normal market phases, the FMM-Fonds focuses on current trends. In extreme situations (such as during euphoric phases), the fund can also follow an anticyclical investment strategy.

Chances

- Flexible, asset-managing management through active adjustment of the fund structure to capital market conditions

- Experienced fund manager following an investment approach based on fundamental, monetary and market-technical analysis (FMM), which has a proven track record since DJE was founded in 1974

- Participation in the growth opportunities of the global stock markets unconstrained of benchmark index parameters

Risks

- The FMM method does not guarantee investment success

- Bonds are subject to price risks when interest rates rise, as well as country risks and the credit and liquidity risks of their issuers

- The value of an investment can go up or down and you may not get back the amount invested.

- Equity prices may exhibit strong volatility depending on market conditions

Target group

Der Fonds eignet sich für Anleger

- who have a medium- to long-term investment horizon and wish to rely on an experienced manager for all decisions on allocation

- who wish to diversify their investments globally across a wide variety of sectors

- who are seeking a fund with an asset management approach

Der Fonds eignet sich nicht für Anleger

- who seek safe returns

- who are not prepared to accept any volatility

- who wish to be fully invested in the equity market at all times

Monthly Commentary

International stock markets performed unevenly in June - strong in the USA, weak in Europe. As expected, the European Central Bank lowered key interest rates, but this interest rate cut was already largely reflected in share prices. In contrast, the European elections and the early elections in France had a negative impact on the stock markets. As announced, the US Federal Reserve maintained its key interest rate level. However, US inflation fell moderately and the core rate excluding food and energy fell even more sharply, meaning that the market's expectations of a key interest rate cut in the current year remained unchanged. This supported the US stock markets. The FMM-Fonds rose by 1.09% in this market environment. Its benchmark index, the MSCI World (EUR), rose by 3.18%. On the global equity market, half of the sub-sectors produced positive results. The best performing sectors were technology, consumer cyclicals and healthcare, while commodities, consumer goods & services and utilities were particularly disappointing. The highest individual stock results came from Deutsche Telekom and the pharmaceutical companies Eli Lilly (USA) and Roche (Switzerland). In contrast, the Canadian mining company Nutrien, the German utility RWE and the German insurer Allianz, among others, were disappointing. The fund management adjusted the allocation over the course of the month and increased the weighting of the technology, insurance and healthcare sectors. In turn, the basic materials, energy and food & beverages sectors, among others, were reduced. The fund's equity allocation rose from 71.97% to 74.87% as a result of the adjustments. The bond ratio fell slightly from 11.01% to 8.84%. The certificate ratio (gold) remained almost unchanged at 2.26% (previous month: 2.27%). Liquidity fell from 14.22% to 13.19%.